In this thread, we will go through the wide-moat investing framework of Morningstar. Over the years, stocks with wide moats, as defined by Morningstar, have managed to outperform the market by a significant margin.

Morningstar rates companies based on their economic moat or competitive advantage. There are 3 categories: wide moat, narrow moat, and no moat. Obviously, we want to focus on the wide moat stocks.

Morningstar describes a moat as a structural business characteristic that allows a firm to generate excess economic returns for an extended period of time. In other words, the ROIC should be higher than the WACC. A wide moat stock should be able to generate a ROIC > WACC for at least 20 years.

So in general, the Return On Invested Capital (ROIC) is truly essential to determining whether a company has a wide moat.

Morningstar states that there are 5 moat types: switching costs, intangible assets, network effects, cost advantages, and efficient scale.

Intangible assets can provide companies with a wide moat. Think about brands, patents, and regulatory licences. Intangible assets can prevent competitors from duplicating a company’s product. Think about Coca-Cola for example.

“If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.”

– Warren Buffett

Switching costs: When the value of switching exceeds the expected value of the benefit, switching costs are created. Companies with switching costs often enjoy a lot of pricing power. Stryker and Salesforce are great examples.

When a company can operate at sustainable lower costs than competitors, cost advantages are created. Firms with a structural cost advantage can either undercut competitors on price while earning similar margins or charge market-level prices while earning relatively high margins. Ikea and Walmart are two companies with strong cost advantages.

Scale economies are the fourth moat source. It is the dynamic in which a market of limited size is effectively served by a few companies. Incumbents generate economic profits, but new entrants would cause returns for all players to fall to a level in line with or below the cost of capital. Think for example, about US railroad stocks like Union Pacific.

The fifth and last moat source are network effects. Network effects are one of the most preferred sources of an economic moat. The more people use a certain product or service, the more valuable the network becomes. Think about companies like Visa and MasterCard, Facebook, and Alphabet.

Does it help to focus on wide moats? YES! Between 2002 and today, the Morningstar Wide Moat index returned 14.45% per year to shareholders, compared to 10.3% for the S&P 500 and 9.2% for the MSCI World.

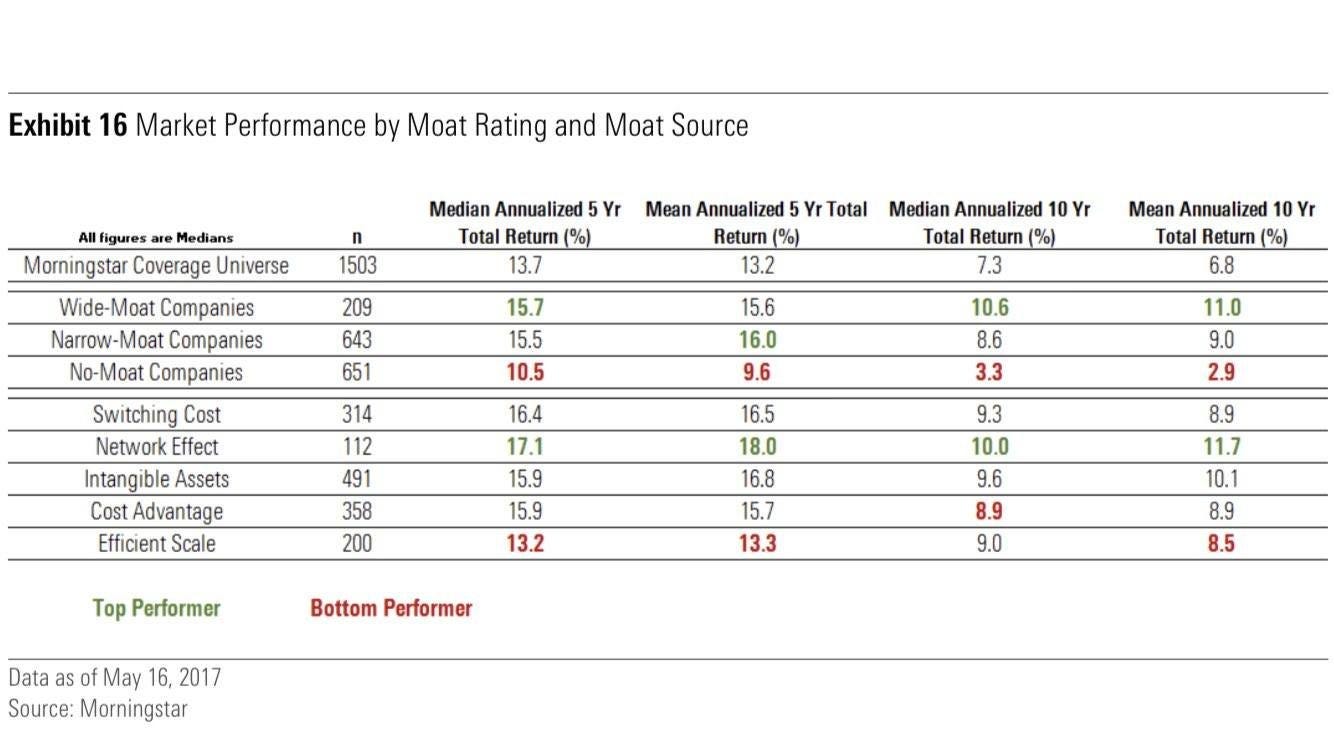

Over a period of 5 to 10 years, wide-moat stocks based on network effects seemed to report the best performance. Cost advantages and efficient scale are the least preferred moat sources.

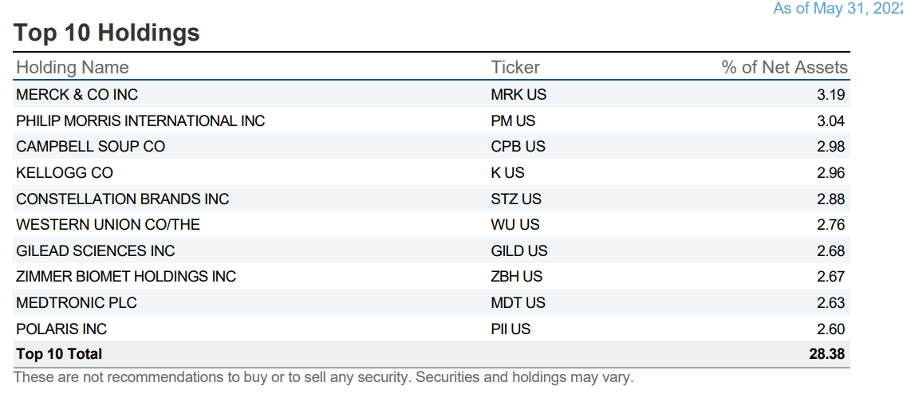

Via Van Eyck, you can invest in the Morningstar Wide Moat Index. Currently, these are the top 10 positions of the Morningstar Wide Moat Index:

All positions with their current weight in the Morningstar Wide Moat Index can be found here:

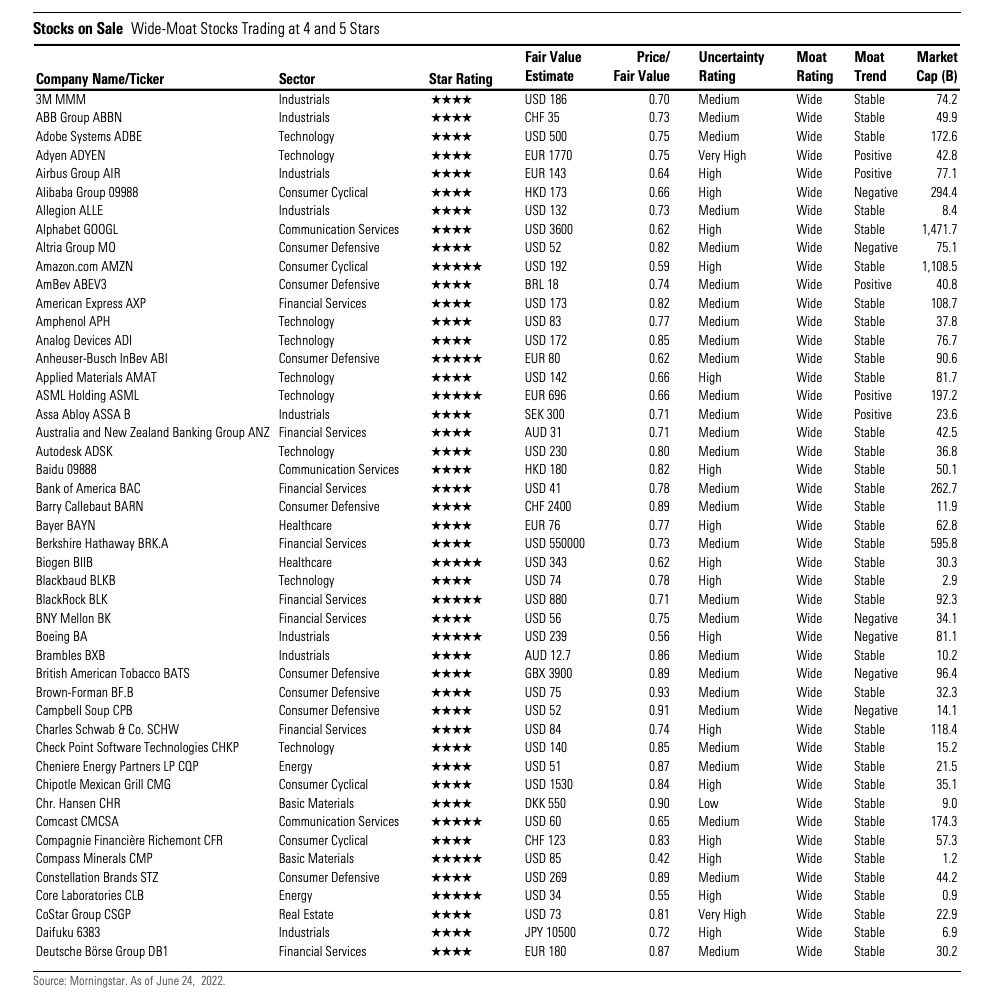

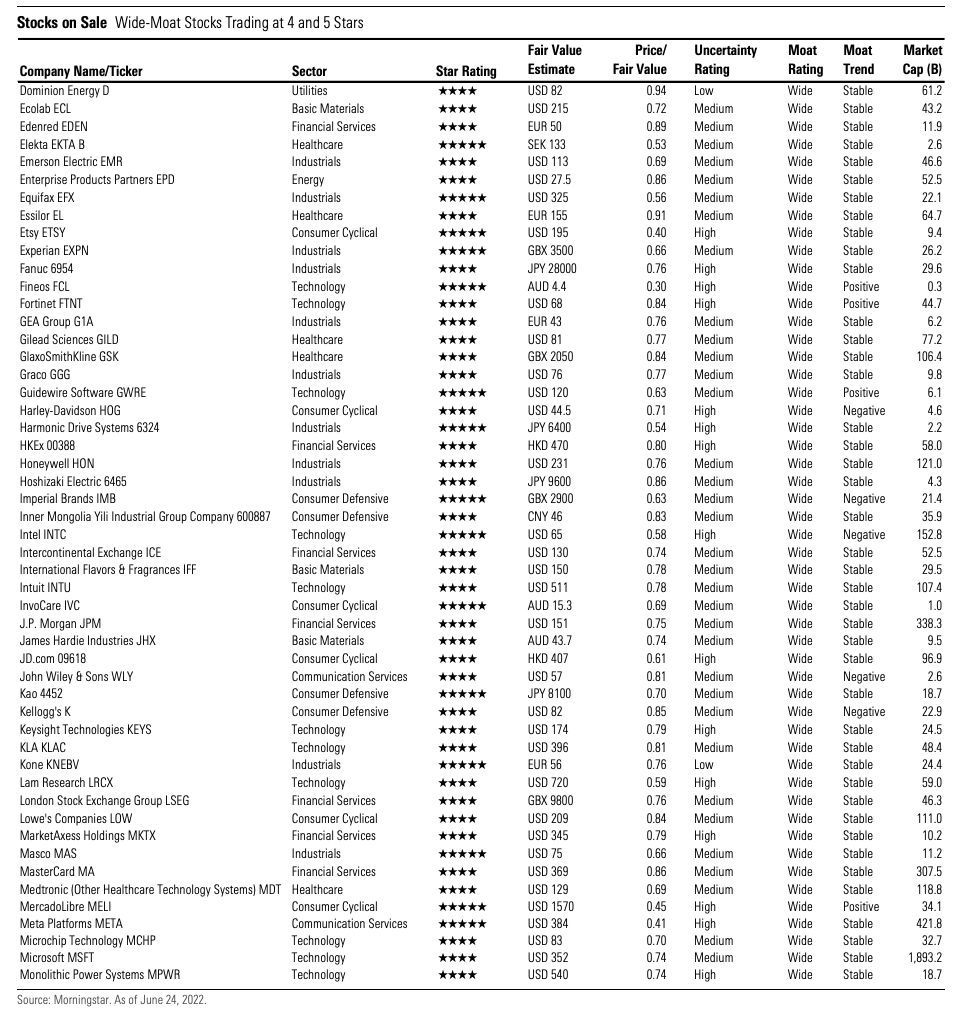

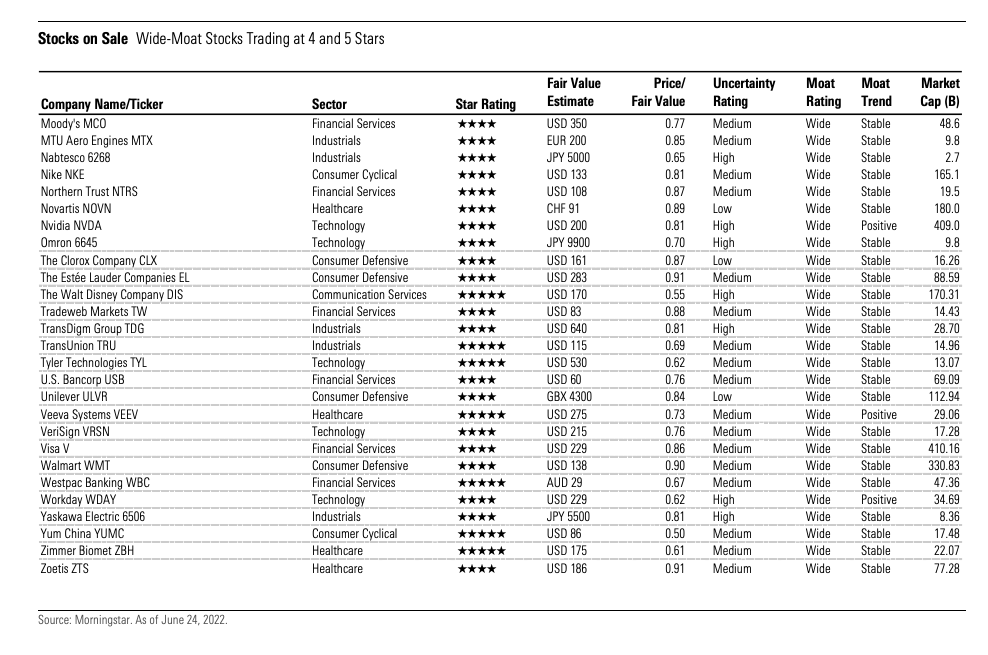

Finally, all undervalued wide moat stocks according to Morningstar are listed hereunder. This list contains a lot of insights for quality investors. When you use the companies below as your investable universe, you are making a great start.

The end. Feel free to reach out to me if you have any questions.

About The Author

Hey, I'm John, a self-confessed finance enthusiast with a clear goal. My life revolves around numbers, market trends, and economic theories. This website is where I break down intricate financial ideas, explore investment strategies, and share my passion for all things finance. Join me on this journey to unravel the intricacies of the financial world.

Wonderful summary, adding value to my thinking, appreciate it!

Excellent Content